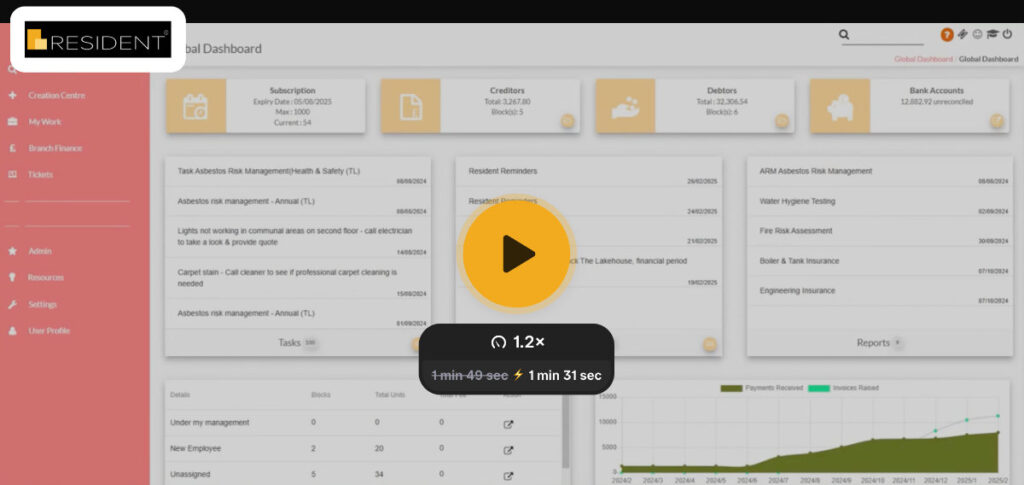

Automatic Bank Reconciliation: A Game Changer for Your Business

Tired of manually reconciling your bank transactions? Imagine a world where your accounting software automatically matches payments and receipts, freeing you from tedious data entry and reconciliation headaches. That world is here!

This blog post explores a new automatic reconciliation feature designed to streamline your financial processes.

Did we mention it’s totally free and available for anyone using CSV import or Bank Feeds?

The Challenge: Manual Reconciliation is Time-Consuming and Prone to Errors

Many businesses still rely on manual bank reconciliation, a process that involves comparing bank statements with internal records. This is not only time-consuming but also susceptible to human error. Discrepancies between the two sets of data can be frustrating to track down and resolve.

The Solution: Automatic Reconciliation

This new feature automates the reconciliation process, significantly reducing manual effort and minimising errors. Let’s walk through a typical scenario:

Import Bank Transactions: Bank transactions can be imported via CSV or via bank feeds.

Record Supplier Payments: Record supplier payments within the system. This is a common use case for businesses using tools like BACS Extract.

Initiate Auto Reconciliation: Navigate to the transaction page, select “More Actions,” and then “Auto Reconciliation.”

How it Works: Intelligent Matching

The system then presents a pop-up screen displaying potential matches. It intelligently compares bank transactions with recorded payments, taking into account various factors:

Perfect Matches: The system identifies exact matches based on description and amount.

Partial Matches: Even if the description or amount isn’t an exact match, the system can still identify potential matches based on partial references or similar amounts. For example, a slight typo in the reference or a small difference in the amount won’t necessarily prevent a match.

Handling Typos and Errors: The system can even handle situations where there are typos in references or incorrect amounts have been processed. This is particularly useful for identifying and reconciling payments where; for instance, a digit might be missing from a numerical reference number.

User Control and Flexibility

The user has complete control over the reconciliation process. They can review the suggested matches and choose which transactions to reconcile. This ensures that the system’s automated suggestions are always reviewed and approved by a human.

Benefits of Automatic Reconciliation

Time Savings: Drastically reduce the time spent on manual reconciliation.

Reduced Errors: Minimise the risk of human error in the reconciliation process.

Improved Accuracy: Ensure greater accuracy in financial records.

Increased Efficiency: Free up valuable time for other important tasks.

How do you get this feature?

Firstly, not everyone may be ready for this level of autonomy, so we have built it specifically to work for those that want it.

Simply drop us an email and we shall reach out to you to discuss your ‘switch-on’ date.

Please take the time to watch the video provided as we are unable to do live demonstrations, due to the vast quantity of Clients this is available to. Once the feature has been added to your dashboard, it will be instantly ready to use!